The Main Principles Of Advisors Financial Asheboro Nc

Wiki Article

Examine This Report about Financial Advisor Certifications

Table of ContentsFinancial Advisor for BeginnersThe Ultimate Guide To Advisor Financial ServicesWhat Does Financial Advisor Do?Not known Facts About Financial Advisor License

There are a number of kinds of financial advisors out there, each with varying qualifications, specializeds, and levels of responsibility. And also when you get on the search for a professional matched to your requirements, it's not unusual to ask, "Just how do I recognize which financial consultant is best for me?" The solution starts with a truthful bookkeeping of your requirements as well as a bit of study.Kinds of Financial Advisors to Think About Depending on your economic demands, you might choose for a generalised or specialized economic consultant. As you begin to dive right into the world of seeking out a financial consultant that fits your requirements, you will likely be offered with lots of titles leaving you asking yourself if you are getting in touch with the best person.

It is very important to keep in mind that some economic consultants additionally have broker licenses (definition they can offer securities), however they are not solely brokers. On the same note, brokers are not all certified similarly as well as are not financial advisors. This is simply among the many factors it is best to begin with a qualified economic planner that can encourage you on your financial investments and also retirement.

Some Known Details About Financial Advisor Salary

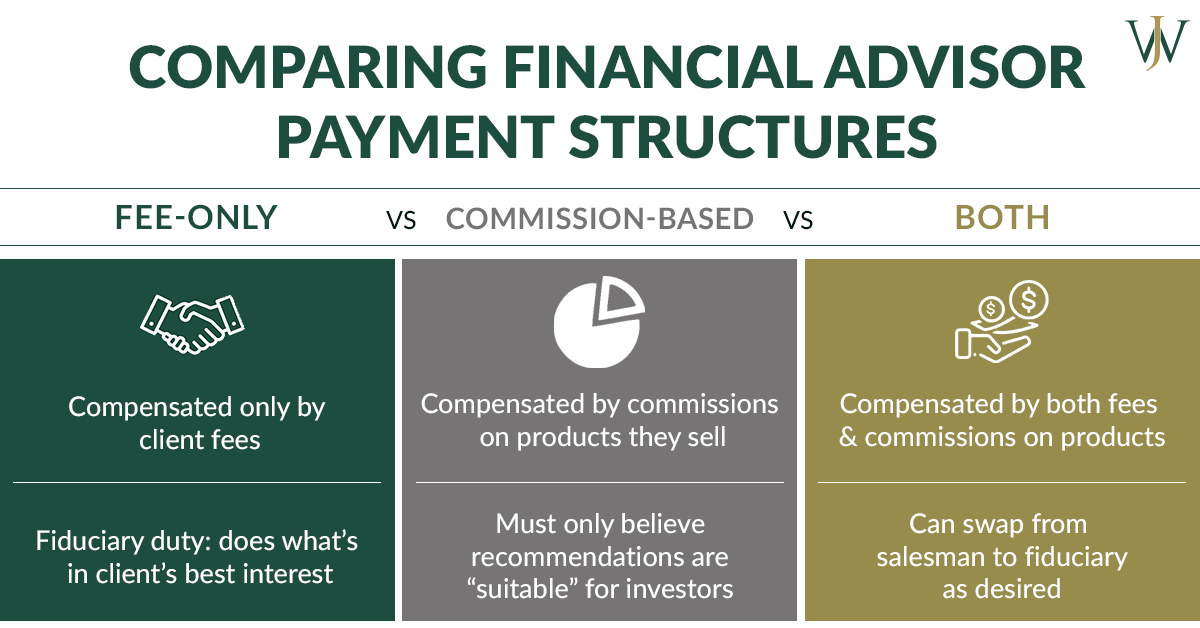

Unlike financial investment consultants, brokers are not paid straight by clients, rather, they gain commissions for trading supplies as well as bonds, and also for selling shared funds and other items.

An accredited estate coordinator (AEP) is an expert that specializes in estate preparation. When you're looking for a financial advisor, it's nice to have an idea what you want help with.

Much like "monetary expert," see "financial organizer" is likewise a broad term. No matter of your specific demands and also financial situation, one standards you need to highly take into consideration is whether a prospective advisor is a fiduciary.

Facts About Financial Advisor Fees Uncovered

To protect on your own from someone that is simply trying to get even more cash from you, it's a good idea to look for an expert that is registered as a fiduciary. A monetary consultant who is signed up as a fiduciary is required, by legislation, to act in the most effective rate of interests of a client.Fiduciaries can just recommend you to utilize such items if they assume it's actually the best financial decision for you to do so. The U.S. Stocks and also Exchange Payment (SEC) controls fiduciaries. Fiduciaries that fall short to act in a customer's finest interests can be struck with penalties and/or jail time of approximately ten years.

That isn't due to the fact that any person can get them. Receiving either accreditation calls for a person to experience a variety of courses and examinations, along with gaining a set amount of hands-on experience. The result of the qualification procedure is that CFPs and also Ch, FCs are well-versed in topics throughout the area of individual money.

The fee could be 1. Charges generally decrease as AUM increases. The alternative is a fee-based advisor.

5 Simple Techniques For Financial Advisor Near Me

An expert's management charge you can try these out might or may not cover the prices linked with trading safeties. Some consultants likewise bill a set fee per transaction.

This is a solution where the expert will bundle all account monitoring expenses, including trading charges and expenditure proportions, right into one comprehensive fee. Due to the fact that this charge covers a lot more, it is typically higher than a charge that just includes monitoring as well as omits points like trading costs. Wrap costs are appealing for their simplicity but likewise aren't worth the cost for everybody.

They likewise bill fees that are well listed below the advisor charges from conventional, human advisors. While a standard expert normally charges a charge in between 1% and also 2% of AUM, the cost for a robo-advisor is usually 0. 5% or much less. The big compromise with a robo-advisor is that you often don't have the capability to chat with a human consultant.

Report this wiki page